This Is How the AI Bubble Will Pop

The AI infrastructure boom is the most important economic story in the world. But the numbers just don't add up.

Some people think artificial intelligence will be the most important technology of the 21st century. Others insist that it is an obvious economic bubble. I believe both sides are right. Like the 19th century railroads and the 20th century broadband Internet build-out, AI will rise first, crash second, and eventually change the world.

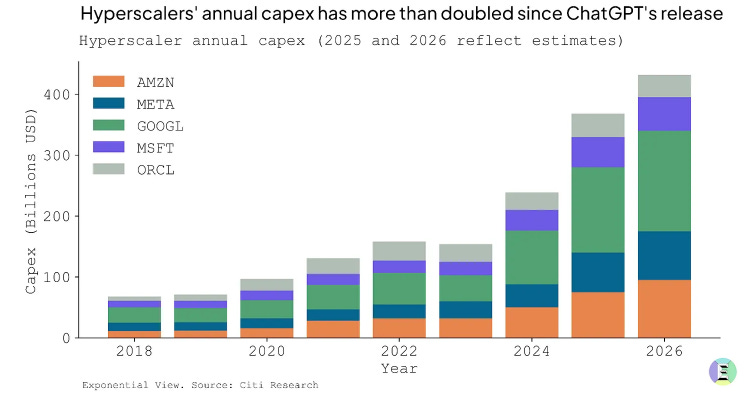

The numbers just don’t make sense. Tech companies are projected to spend about $400 billion this year on infrastructure to train and operate AI models. By nominal dollar sums, that is more than any group of firms has ever spent to do just about anything. The Apollo program allocated about $300 billion in inflation-adjusted dollars to get America to the moon between the early 1960s and the early 1970s. The AI buildout requires companies to collectively fund a new Apollo program, not every 10 years, but every 10 months.

It’s not clear that firms are prepared to earn back the investment, and yet by their own testimony, they’re just going to keep spending, anyway. Total AI capital expenditures in the U.S. are projected to exceed $500 billion in 2026 and 2027—roughly the annual GDP of Singapore. But the Wall Street Journal has reported that American consumers spend only $12 billion a year on AI services. That’s roughly the GDP of Somalia. If you can grok the economic difference between Singapore and Somalia, you get a sense of the economic chasm between vision and reality in AI-Land. Some reports indicate that AI usage is actually declining at large companies that are still trying to figure out how large language models can save them money.

Every financial bubble has moments where, looking back, one thinks: How did any sentient person miss the signs? Today’s omens abound. Thinking Machines, an AI startup helmed by former Open AI executive Mira Murati, just raised the largest seed round in history: $2 billion in funding at a $10 billion valuation. The company has not released a product and has refused to tell investors what they’re even trying to build. “It was the most absurd pitch meeting,” one investor who met with Murati said. “She was like, ‘So we’re doing an AI company with the best AI people, but we can’t answer any questions.” Meanwhile, a recent analysis of stock market trends found that none of the typical rules for sensible investing can explain what’s going on with stock prices right now. Whereas equity prices have historically followed earnings fundamentals, today’s market is driven overwhelmingly by momentum, as retail investors pile into meme stocks and AI companies because they think everybody else is piling into meme stocks and AI companies.

Every economic bubble also has tell-tale signs of financial over-engineering, like the collateralized debt obligations and subprime mortgage-backed securities that blew up during the mid-2000s housing bubble. Ominously, AI appears to be entering its own phase of financial wizardry. As the Economist has pointed out, the AI hyperscalers—that is, the largest spenders on AI—are using accounting tricks to depress their reported infrastructure spending, which has the effect of inflating their profits1. As the investor and author Paul Kedrosky told me on my podcast Plain English, the big AI firms are also shifting huge amounts of AI spending off their books into SPVs, or special purpose vehicles, that disguise the cost of the AI build-out.

My interview with Kedrosky received the most enthusiastic and complimentary feedback of any show I’ve done in a while. His level of insight-per-minute was off the charts, touching on:

How AI capital expenditures break down

Why the AI build-out is different from past infrastructure projects, like the railroad and dot-com build-outs

How AI spending is creating a black hole of capital that’s sucking resources away from other parts of the economy

How ordinary investors might be able to sense the popping of the bubble just before it happens

Why the entire financial system is balancing on big chip-makers like Nvidia

If the bubble pops, what surprising industries will face a reckoning

Below is a polished transcript of our conversation, organized by topic area and adorned with charts and graphs to visualize his points. I hope you learn as much from his commentary as much as I did. From a sheer economic perspective, I don’t think there’s a more important story in the world.

AI SPENDING: 101

Derek Thompson: How big is the AI infrastructure build-out?

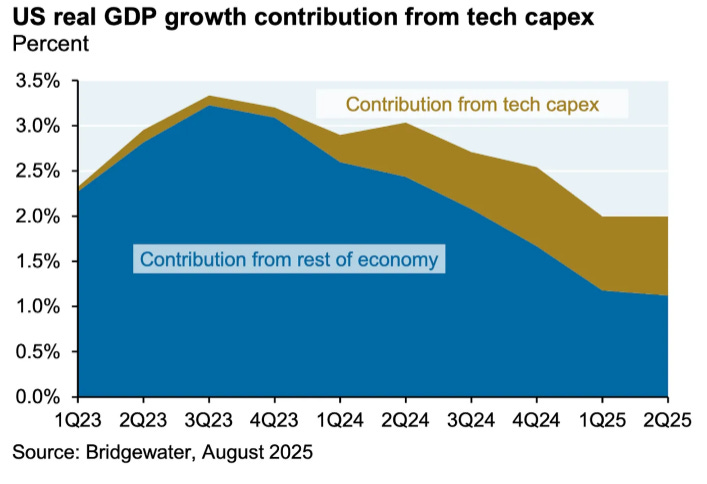

Paul Kedrosky: There’s a huge amount of money being deployed and it’s going to a very narrow set of recipients and some really small geographies, like Northern Virginia. So it’s an incredibly concentrated pool of capital that’s also large enough to affect GDP. I did the math and found out that in the first half of this year, the data-center related spending—these giant buildings full of GPUs [graphical processing units] and racks and servers that are used by the large AI firms to generate responses and train models—probably accounted for half of GDP growth in the first half of the year. Which is absolutely bananas. This spending is huge.

Thompson: Where is all this money going?

Kedrosky: For the biggest companies—Meta and Google and Amazon—a little more than half the cost of a data center is the GPU chips that are going in. About 60 percent. The rest is a combination of cooling and energy. And then a relatively small component is the actual construction of the data center: the frame of the building, the concrete pad, the real estate.

HOW AI IS ALREADY WARPING THE 2025 ECONOMY

Thompson: How do you see AI spending already warping the 2025 economy?

Kedrosky: Looking back, the analogy I draw is this: massive capital spending in one narrow slice of the economy during the 1990s caused a diversion of capital away from manufacturing in the United States. This starved small manufacturers of capital and made it difficult for them to raise money cheaply. Their cost of capital increased, meaning their margins had to be higher. During that time, China had entered the World Trade Organization and tariffs were dropping. We’ve made it very difficult for domestic manufacturers to compete against China, in large part because of the rising cost of capital. It all got sucked into this “death star” of telecom.

So in a weird way, we can trace some of the loss of manufacturing jobs in the 1990s to what happened in telecom because it was the great sucking sound that sucked all the capital out of everywhere else in the economy.

The exact same thing is happening now. If I’m a large private equity firm, there is no reward for spending money anywhere else but in data centers. So it’s the same phenomenon. If I’m a small manufacturer and I’m hoping to benefit from the on-shoring of manufacturing as a result of tariffs, I go out trying to raise money with that as my thesis. The hurdle rate just got a lot higher, meaning that I have to generate much higher returns because they’re comparing me to this other part of the economy that will accept giant amounts of money. And it looks like the returns are going to be tremendous because look at what’s happening in AI and the massive uptake of OpenAI. So I end up inadvertently starving a huge slice of the economy yet again, much like what we did in the 1990s.

Thompson: That’s so interesting. The story I’m used to telling about manufacturing is that China took our jobs. “The China shock,” as economists like David Autor call it, essentially took manufacturing to China and production in Shenzhen replaced production in Ohio, and that’s what hollowed out the Rust Belt. You’re adding that telecom absorbed the capital.

And now you fast-forward to the 2020s. Trump is trying to reverse the China shock with the tariffs. But we’re recreating the capital shock with AI as the new telecom, the new death star that’s taking capital that might at the margin go to manufacturing.

Kedrosky: It’s even more insidious than that. Let’s say you’re Derek’s Giant Private Equity Firm and you control $500 billion. You do not want to allocate that money one $5 million check at a time to a bunch of manufacturers. All I see is a nightmare of having to keep track of all of these little companies doing who knows what.

What I’d like to do is to write 30 separate $50 billion checks. I’d like to write a small number of huge checks. And this is a dynamic in private equity that people don’t understand. Capital can be allocated in lots of different ways, but the partners at these firms do not want to write a bunch of small checks to a bunch of small manufacturers, even if the hurdle rate is competitive. I’m a human, I don’t want to sit on 40 boards. And so you have this other perverse dynamic that even if everything else is equal, it’s not equal. So we’ve put manufacturers who might otherwise benefit from the onshoring phenomenon at an even worse position in part because of the internal dynamics of capital.

Thompson: What about the energy piece of this? Electricity prices rising. Data centers are incredibly energy thirsty. I think consumers will revolt against the construction of local data centers, but the data centers have enormous political power of their own. How is this going to play out?

Kedrosky: So I think you’re going to rapidly see an offshoring of data centers. That will be the response. It’ll increasingly be that it’s happening in India, it’s happening in the Middle East, where massive allocations are being made to new data centers. It’s happening all over the world. The focus will be to move offshore for exactly this reason. Bloomberg had a great story the other day about an exurb in Northern Virginia that’s essentially surrounded now by data centers. This was previously a rural area and everything around them, all the farms sold out, and people in this area were like, wait a minute, who do I sue? I never signed up for this. This is the beginnings of the NIMBY phenomenon because it’s become visceral and emotional for people. It’s not just about prices. It’s also about: If you’ve got a six acre building beside you that’s making noise all the time, that is not what you signed up for.